I have been asked by a friend about my opinion on a small crypto currency. How he has read about it and that he now believes that it might 10x or even more. Because he was super bullish on it, he has now invested a couple of hundred bucks into it. Not more, because it still is a little risky after all… At least he understood the last part and didn’t loose too much after. I told him he should focus on the big movers of his portfolio. Even if it would have been a 10x or more, the amount it would have moved his portfolio would have been rather small.

What I try to say is that becoming successful long term in investing, one needs an efficient portfolio. An investor should focus on the big movers of his portfolio and try to optimize the return of these investments while minimizing their risk. A strategy should make up 10%, 20% or even 30% of a portfolio. Only then it will impact the portfolio significantly. If you can get good return on those, you don’t need small gambles to be successful long term. And having just a couple of good strategies allows you to focus on them, learn from the inevitable, small mistakes and improve the strategy over time.

As mentioned in other articles, it starts with having realistic expectation. It’s like everything in life. If your goals are realistic (but still ambitious) and you work hard, you will succeed. The example of my friend just shows: He wanted to become rich in a very short period by taking insane risk. It might just have worked out if he would have invested a big part of his portfolio into it. But at what risk…

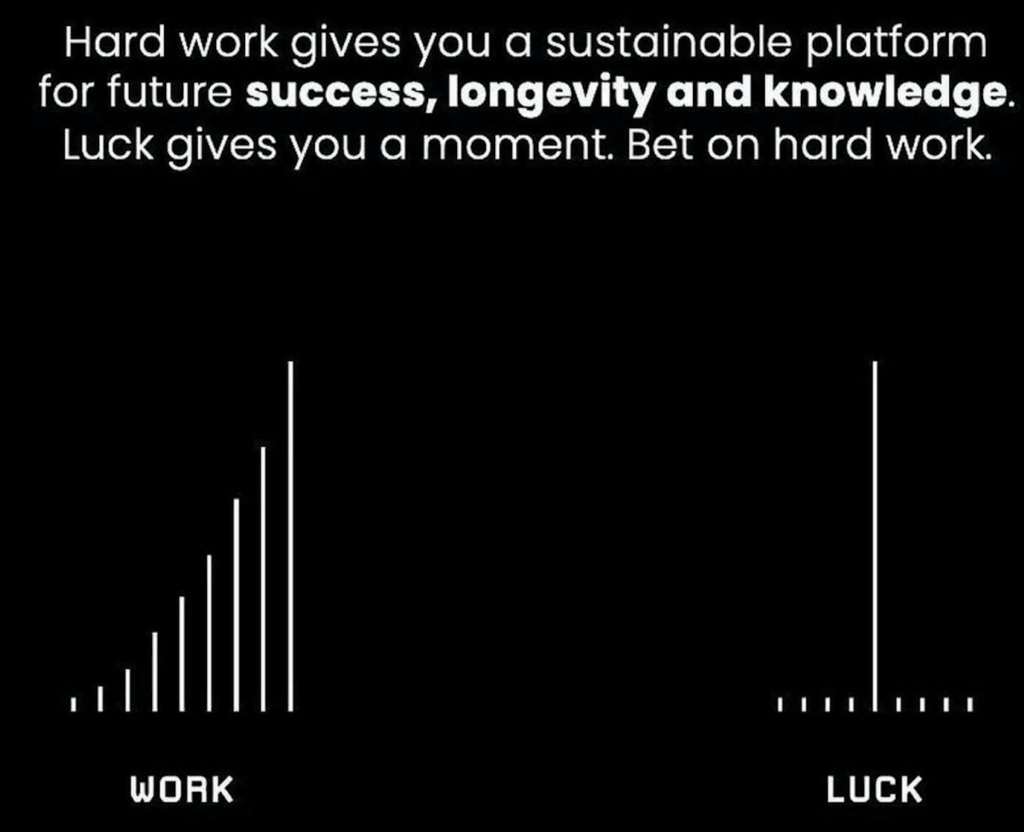

The following picture shows my point perfectly. There are people who had luck with their investments and made a huge return on something super risky. But it is pure luck! And there are very few people who will become rich with it. Just like with the lottery. And no one (at least I hope) invests all his money into the lottery.

My philosophy is different. Work hard over an extended period, keep the risk/reward ratio in my favor and get the expectation right. And I’ll get to the finish line with a high probability. That’s why I keep my portfolio as efficient as possible.

As an example: If I have a portfolio of 10’000$ and, as a savvy investor, I’m able to get 10% per year, after 10 years I’ll have 25’937$. This is realistic. If, however, I’m a risk taker and I use 5% of my total portfolio (in that case 500$) for high-risk investments, to get to the same amount after 10 years I would need a profit of 5187%. Needless to say that such investments are very rare and hugely unlikely to get. And the probability of such a trade to have result in total loss is more than likely. I would strongly suggest that people don’t spend any time looking for such one-hit-wonders. Even if they happen from time to time the probability of having one is just very small. Normally, the FOMO (fear of missing out) is the reason why people even take these trades. However, if an investor has a working, very boring strategy which allows for an efficient portfolio, there is no need to take excessive risk.

As a summary for me, allocation sizes of 10%-30% are reasonable. Only if the risk/reward is good of course. With such allocations sizes I’m able to grow my grand total efficiently and focus on what works long term.