It might be a little counterintuitive, but to be able to achieve a great investing career, the potential upside of an investment is not my main focus. It is a very important part of course, but not my focus number one. Rather, drawdown reduction is one of my key foci in all of my investing. Getting the right risk/reward ratio in every trade is my top priority. This might mean that I will skip a trade that potentially can make 100% or more. If the probability of a big loss is too high, it is just not worth taking a trade.

Yes, you can make a fortune going rogue and invest all your money on Tesla or Bitcoin. But what are the odds of finding such an investment early enough and being able to hold on for an extended time? And what is the probability that this trade will lose most of its value and you quitting. This should be top of mind every time when we take a trade.

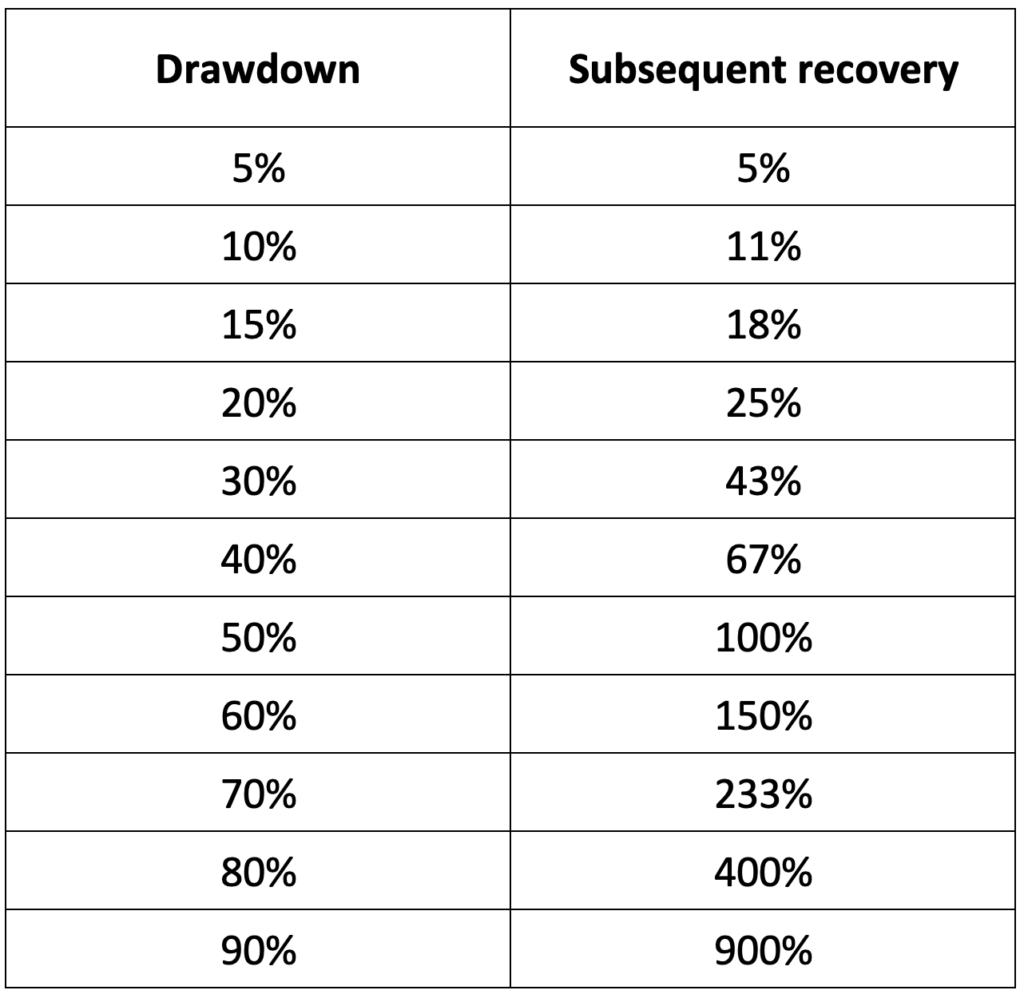

Let us have a look at why drawdown reduction is so important. The answer is in the math. In the table below you’ll find for some drawdowns the subsequent needed recovery to get back to the previous high. If you lose 50%, which can happen on a bigger recession (like 2000 or 2008) it is not enough to make 50% go get back. You’ll need a full 100%! How many of your trades doubled your total portfolio? To be able to get a return of 100% on a total portfolio it might take years. For the S&P 500, after the financial crisis 2008 (-56%), it took about 3.5 years to get back to the previous high. And this only if an investor stayed invested for the whole time. Many retail investor pulled the plug in the middle of the crisis and missed a lot of the recovery. A larger drawdown can cost you years, even decades to make up to it. That’s why I prefer to look at what I might loose and not too much on what I can gain.

Every investor will have periods of losses. Even the best investors do have them. But they are only occasionally and not too impactful on the long run. Therefore, they are able to recover rather quickly. They are able to make two big steps forward while only having to do a fraction of a step back here and there. Thus, they are able to stay their course over a lifetime.

This mathematical “problem” is also the reason why leverage is so dangerous. Yes, you can boost your upside performance. But if you’re not able to reduce those drawdowns, you might just get wiped out along the way. Just look at the S&P 500 (SPY) vs the 2x S&P 500 (SSO). Even though the leveraged ETF outperformed the non-leveraged one, it had a very bumpy ride along the way. When you look at the low of the covid crash. Who would have being able to hold on during a -61% crash for the SSO. And after the 2008 crash, it took the leveraged ETF about 5 years to break even with the non-leveraged fund. This during a period where the stock market went nothing but up afterwards.

If however, you are able to manage those drawdown periods, the story starts to change. And adding a little leverage here and there really starts to materialize. That is why my focus lies on reducing drawdowns.

How about you?