One of the most difficult things to achieve as an investor is to have a consistent, good return over a very long period. Consistent, because you want to be able to follow it over the time without pulling the plug in the worst possible moment. And a good return, so that you reach your financial goals. Remember, we’re not talking about 30%, 40%, 50%+ a year. Low double-digits are more than enough if you start at a young age. Now that sounds not very ambitious, does it? But let us have a look at some past returns. What are the “professionals” over at Wall Street getting? And why should we “amateurs” even be able to beat them? The reason is actually quite simple.

So. What are the average returns of institutional investors or hedge funds?

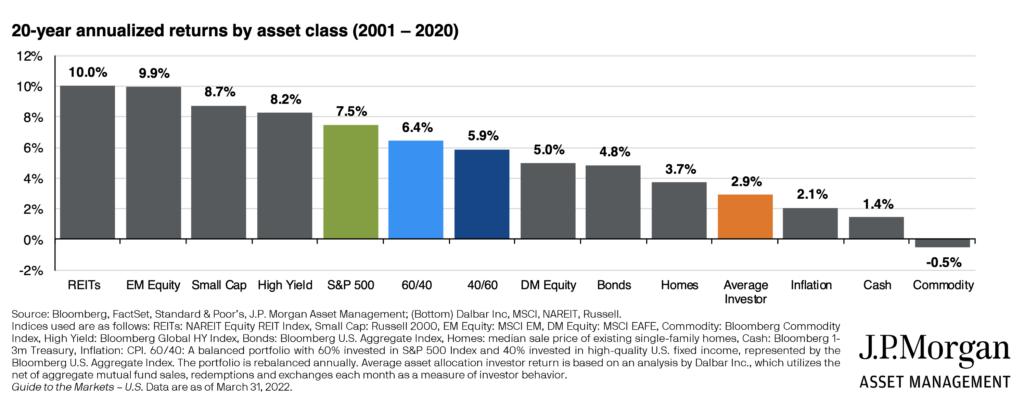

- According to J.P. Morgan, the average investors yearly return from 2001-2020 was about 2.9%. Now, don’t forget that this 20-year period was about the best you could get. Pretty much everything went up. Looking at the average funds out there, most of them will have a structure like 60/40 or 40/60 stocks and bonds. Thus, resulting in a 5.9% and 6.4% respectively. Even the highly praised REITs made “only” a 10% yearly return. Are this the returns you were expected? If not, then advertisements and social media did quite the job on you. The last 3-5 years have been so great that many forget what the real world over a long timeframe looks like.

- If you want to learn more about hedge funds performances, than head over to this page: https://www.hfr.com

Why should we “amateur” investors be able to beat the institutions?

After all, these guys are some of the world’s smartest people dedicating 7 days a week 10+ hours a day to get the best performance. They have all the insights and access to all the news we can’t afford. Is there even a way to get close to their performance? The answer is, of course, yes. We do have a couple of advantages over any institutional investor. That’s all we need. Let’s look at some of them:

- Small budget: Lately I heard that at a big local bank, to be considered “entry-level” rich you’d need 25 Mio. Crazy, right… What I want to say is that institutional investors manage funds of hundreds of millions up to many billions of dollars. Compared to the financial world (almost) every budget of a private investor is ridiculously small. We can use that advantage for us. With a small budget, we are able to enter or exit any trade in a matter of seconds. In case of a crash for example, we don’t have to take the full drawdown. Rather, we can exit the trade as early as our signals flag “danger” and enter at a later, saver period. Plus, we can use smaller products which meet our requirements. Big funds can’t do that efficiently.

- Regulation: A private investor has much less regulation issues. I’m currently working at an insurance company, and in times of a bigger drawdown we are legally obliged to close down big parts of our stock exposures and move to bonds. This is a huge disadvantage. As private investors, many different ways to invest are possible and our legal obligations are set to a minimum. Your broker mostly handles that. In addition, we can choose by ourselves in which investment-vehicles we want to invest. Stocks, ETFs, Bonds, Options, Futures, etc. to name a few. Whatever fits us best.

- We don’t have customers: This might be our greatest edge, as we don’t have to meet expectations you’ve made in the first place to get customers invest in your fund. Not having to focus on pleasing any customers, we can fully concentrate on the investment-process and don’t have to talk for hours about why we did this or that or about whatever a customer wants to hear. For example, being in a drawdown even if we took the right choices is a normal thing. If your strategy is good, in the long run the results will be great. And having a mediocre period is not the end of the world because you’re losing all your customers. Just stick to the process and stay cool & motivated. The institutional investor can’t do that. He has to change his strategy, maybe chase the “next hottest thing” so that his customers are happy. As a result, most probably they take bad decisions not beneficial for the long term.

The only one we private investors have to suffice is ourselves. We just have to beware of not lying to ourselves. One should still report the performance as if he is his own customer to stay critical with the process in place.

This are just some of our advantages, but they weigh heavily. In the long run, using these edges will boost our performance compared to the average institutional investor. We might just get this 12+% a year we’re focusing on. Everything we get on top of that, we’ll take gladly knowing that that is exceptional. That is why we should focus on our strengths and not try to mimic any Wall Street Gurus.